About Lamina Brokers

The Best Strategy To Use For Lamina Brokers

Table of ContentsNot known Factual Statements About Lamina Brokers See This Report on Lamina BrokersThe Definitive Guide to Lamina Brokers4 Simple Techniques For Lamina Brokers8 Simple Techniques For Lamina BrokersThe Ultimate Guide To Lamina Brokers

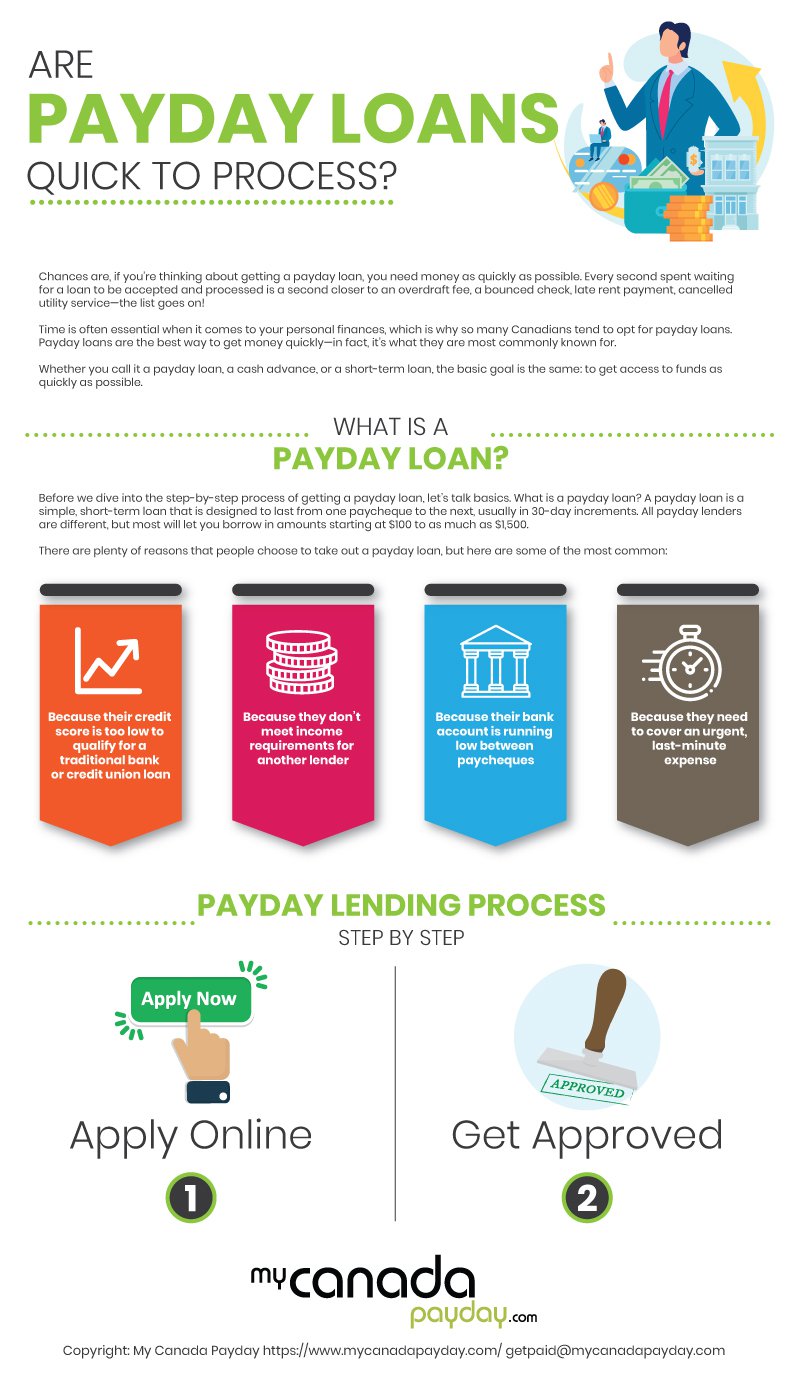

In this write-up, we'll discover what payday advance online are, just how they vary from typical car loans, and why individuals resort to them for emergency situation funds. Payday advance loan online are temporary lendings that are provided via online lenders. They are made to be settled on the consumer's following payday, and they include really high-interest rates and costs.The application procedure is typically quick as well as easy, and also consumers can frequently obtain their cash within a few hours. There are several reasons people count on online payday advance. Among the main factors is that they need money urgently and don't have accessibility to other forms of credit score.

Furthermore, online payday advance can be easier than traditional lendings, as debtors can finish the whole procedure online from the convenience of their own residences. Some individuals may transform to on-line payday financings because they can not obtain approved for other kinds of credit score due to their credit score history or revenue.

Top Guidelines Of Lamina Brokers

Several customers find themselves trapped in a cycle of financial debt, obtaining brand-new payday advance to pay back old ones. This can lead to an endless cycle of financial debt that is difficult to escape. Before securing a cash advance car loan, it is very important to very carefully consider whether it is the finest alternative for your financial situation.

To conclude, online cash advance are a kind of temporary finance that is provided with online lending institutions. They can be practical as well as quickly, but they come with extremely high-interest rates as well as costs. Before obtaining a payday advance, it's crucial to thoroughly take into consideration whether it is the very best choice for your monetary scenario, and to discover other kinds of debt that may be less costly and much easier to repay.

In this article, we will certainly discuss how to get payday loans online in the Philippines. Obtaining cash advance online in the Philippines is an easy and convenient procedure. Most online finance companies have a straightforward internet site that guides you via the procedure step by action. Typically, the application process entails submitting an on-line application as well as uploading the needed records.

The Single Strategy To Use For Lamina Brokers

Authorization time and also just how much you can borrow The authorization time for payday advance online in the Philippines differs depending on the loan provider. However, a lot of loan providers will provide you with a choice within 24 hours of receiving your application. The quantity you can likewise obtain varies relying on the loan provider.

Payday fundings have actually come to be a popular means to obtain cash in the Philippines. They are a sort of temporary financing developed to give quick cash money to borrowers that require it one of the most - Lamina Brokers. These finances are usually utilized to cover unanticipated expenditures or bills that can't be paid with the debtor's present earnings.

A Biased View of Lamina Brokers

High-interest rates On the internet payday advance loan have greater rates of interest than standard lendings. This is due to the fact that they are designed to be short-term financings, and loan providers need recommended you read to make a profit within a short time period. The high-interest rates can make it hard for borrowers to repay the finance, and can bring about a cycle of financial obligation.

This means that customers might not have the very same protections as well as civil liberties as they would certainly with a standard financing. In the Philippines, cash advance are a prominent option for borrowers that need quick cash to cover unanticipated expenditures or expenses. These car loans are generally made to be short-term car loans that are repaid within a couple of weeks or months.

Some Known Details About Lamina Brokers

Nonetheless, there are some differences between on the internet payday advance loan and also conventional car loans. Lamina Brokers. In this post, we will discover the differences between these 2 kinds of finances, and also assistance consumers identify which one is much better for their needs. Application process The most original site significant distinction between online and typical loans is the application procedure.

This can be bothersome and also taxing, specifically for consumers that live much from the nearest store. On the other hand, online payday advance permit consumers to get a lending from their own home or workplace, making use of a computer system or smart device. Rate of authorization Online payday advance are usually authorized faster than conventional fundings.

In comparison, traditional loans might take a number of hrs or even days to be approved. Rate of interest prices as well as fees On-line cash advance loans have a tendency to have greater rate of interest prices and costs than typical lendings.

More About Lamina Brokers

This can be challenging for debtors that are already having a hard time to make ends meet - Lamina Brokers. On the other hand, on the internet payday advance may use more adaptable payment options, permitting customers to repay the lending over a longer amount of time. The response to this question relies on the debtor's individual needs and also preferences.